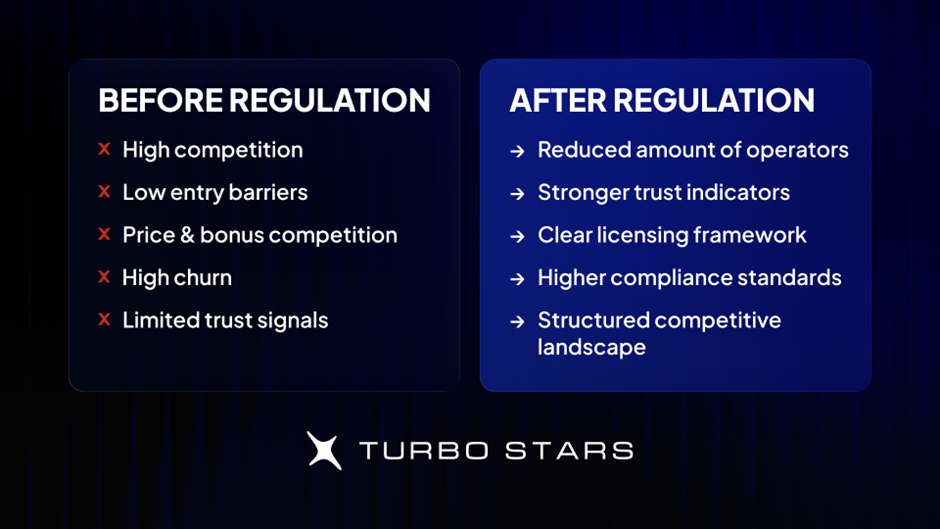

When a market introduces gambling regulation, the initial reaction is not always positive. For some operators, new requirements mean more paperwork, ongoing audits, technical certifications, higher legal costs, and expanded compliance teams. In the short term, it can feel like friction slowing down growth.

But difficulty is not the same as disadvantage.

Regulation does not close doors. It reshapes them. And for those prepared to adapt, it often strengthens them.

The Line Between Serious Operators and Short-Term Players

The introduction of a regulatory framework becomes a defining moment. Some operators shift their focus toward less regulated markets where entry barriers are lower and oversight is lighter. Others choose to adapt and invest.

That decision separates structured, long-term businesses from short-term opportunistic ventures.

Through its experience as a technology partner in regulated and emerging markets, Turbo Stars has consistently observed the same pattern. When regulation enters a market, weaker operators exit because they cannot meet the new standards. Those who remain do more than survive. They gain access to a more stable, trustworthy environment with stronger long-term growth potential.

Trust Changes Player Behaviour

One of the most underestimated effects of regulation is its impact on player psychology.

In regulated markets, players tend to deposit with greater confidence and remain active longer. The reason is security. When a player sees a licence issued by a recognised authority, they perceive oversight and accountability. That perception reshapes their relationship with the brand.

This shift is not primarily driven by bonuses or aggressive marketing campaigns. Before any promotional incentive, players need legitimacy. When they feel their funds are protected and that a legal framework supports their experience, behaviour changes.

The result often includes higher conversion rates, larger first-time deposits, and longer player lifecycles compared to unlicensed competitors operating in the same market.

Regulation as a Competitive Filter

Regulation also reshapes the competitive landscape.

Licence fees, technical audits, certifications, and local compliance requirements do more than raise operational standards. They create meaningful barriers to entry that protect those who have already invested in compliance.

At the same time, competition evolves. In unregulated environments, the battle often revolves around who can spend more on traffic acquisition. In regulated markets, the focus shifts toward retention, user experience, and trust-building.

Competition becomes less about aggressive spending and more about sustainable performance.

The Advantage of Moving Early

Timing is another critical factor.

When new licensing frameworks are announced, many operators hesitate due to administrative complexity, uncertain timelines, and unclear legal costs. That hesitation creates a strategic window.

Brazil provides a clear example. When the licensing window opened in May 2024, Kaizen Gaming, through its brand Betano, submitted its application within five days. More than 50 of the 113 total applicants waited until the final submission day.

When the regulated market officially launched on 1 January 2025, only 14 operators received full authorisation immediately, while others were required to address compliance issues. By that time, Betano had already captured approximately 24.88 percent market share and secured a dominant position.

Regulation did not create the advantage. Early action did.

The Window Does Not Stay Open Forever

The global direction is clear. Latin America, parts of Africa, and several emerging Asian markets are moving toward structured regulatory frameworks. What was recently considered grey-market territory is increasingly becoming regulated space.

The strategic question is not whether to adapt. It is when.

Operators who see compliance purely as an operational burden often react too late. Those who view it as a strategic investment move earlier, secure key partnerships, establish traffic channels, and capture market share while competitors hesitate.

As barriers to entry rise, those early positions become increasingly difficult to challenge.In a maturing global industry, regulation is not the enemy of growth. It is the mechanism that separates improvisation from structure, short-term tactics from long-term sustainability, and market noise from true leadership.